Powerball jackpot jumps to $546 million as the prize keeps growing — here’s how much the winner would actually take home after taxes

-

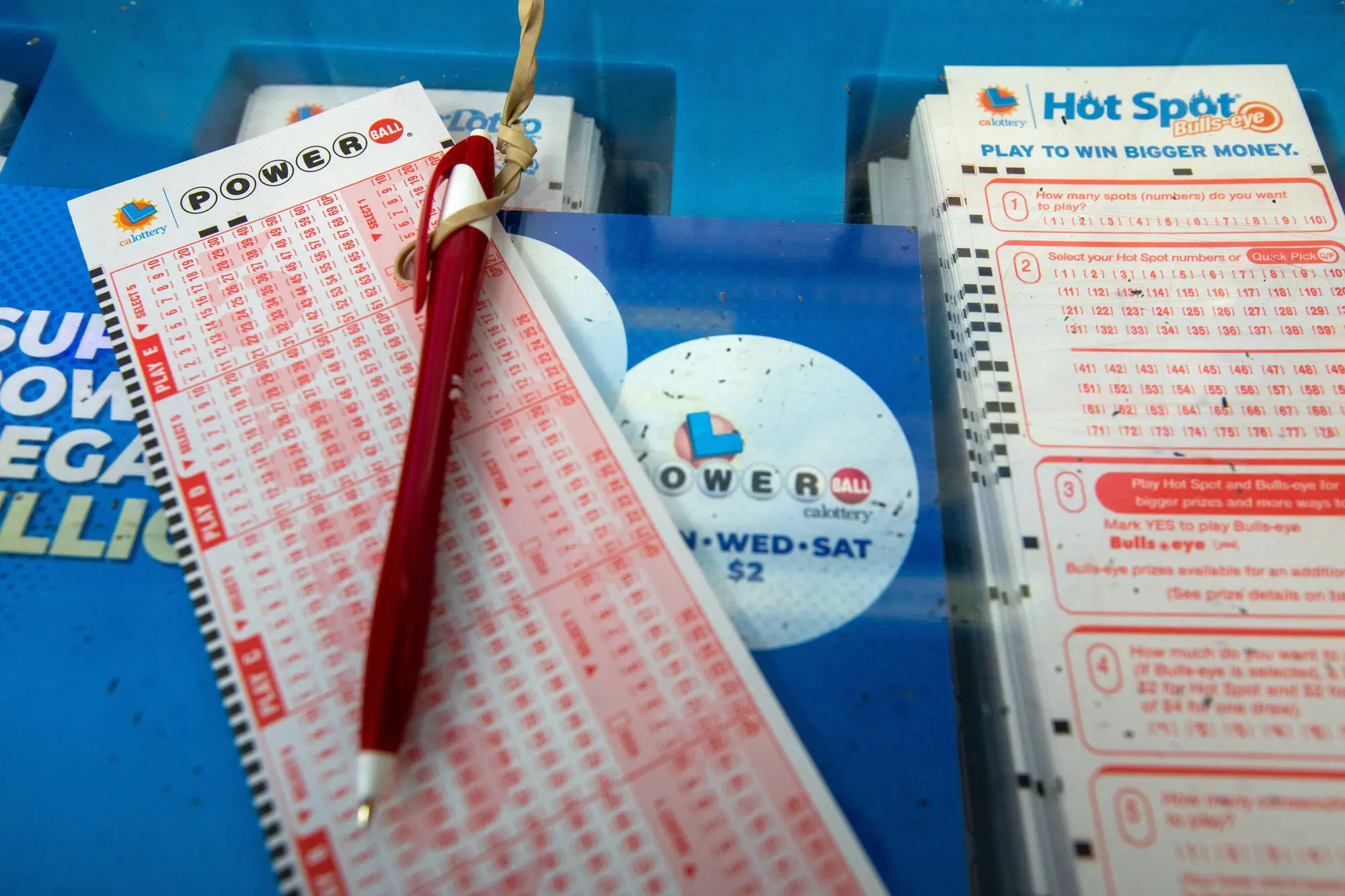

South Pasadena, CA - October 01: Powerball and Mega Millions lotto tickets are sold at Foremost Liquor Store on Sunday, Oct. 1, 2023, in South Pasadena, CA. The Powerball lottery has reached the 1 billion mark with an estimated $1.04 billion jackpot, for the next drawing on Monday night after no grand prize winner in Saturday's drawing. (Francine Orr / Los Angeles Times via Getty Images)

South Pasadena, CA - October 01: Powerball and Mega Millions lotto tickets are sold at Foremost Liquor Store on Sunday, Oct. 1, 2023, in South Pasadena, CA. The Powerball lottery has reached the 1 billion mark with an estimated $1.04 billion jackpot, for the next drawing on Monday night after no grand prize winner in Saturday's drawing. (Francine Orr / Los Angeles Times via Getty Images)The Powerball jackpot has gone up again and is now $546 million. No one matched all the winning numbers in the last few draws, so the prize has continued to roll over. This has made the jackpot one of the biggest of the year, and many people are buying tickets hoping they might win.

But even though the jackpot is listed as $546 million, the winner does not get to keep the whole amount. A large part of the money goes toward taxes. Here is an easy breakdown of what the winner may actually receive.

Two payment options

The winner can choose between two types of payments:

-

Annuity:

The full $546 million paid over 29 years in small payments every year. -

Lump sum:

One big payment taken at once. This amount is always less than the full jackpot.

For this draw, the lump-sum payment is expected to be around $258.5 million.

Most winners usually choose the lump-sum option.

How taxes reduce the prize

Federal taxes

The U.S. government takes 24% of the prize right away.

-

Lump sum: $258.5 million

-

Federal withholding (24%): about $62 million

-

Remaining amount: around $196 million

Later, the winner may owe a little more during tax season because the top tax bracket is higher than 24%. After all federal taxes, the winner may get around $165 million to $175 million.

State taxes

State taxes depend on where the winner lives. Some states take no lottery tax at all, while others take more.

-

No tax: Florida, Texas, Tennessee, Wyoming, South Dakota, Washington

-

High tax states: New York, New Jersey, Maryland

If the winner is from a state with no tax, they keep more money. If they are from a state with high tax, the take-home amount is lower.

Why the jackpot keeps growing

The Powerball jackpot increases every time no one matches all six numbers. Since the odds of winning the jackpot are very low — 1 in 292 million — it is common for the prize to roll over many times. This is why the jackpot grows so quickly.

With the prize now at $546 million, even more people are expected to buy tickets before the next draw.

When is the next draw?

The next Powerball draw is on Saturday at 10:59 p.m. ET. Each state has its own ticket cut-off time, so players need to buy tickets before sales close.

The winning numbers will be posted soon after the draw.

A big prize even after taxes

Even though the winner will not get all $546 million, the final amount is still very large. Whether they choose the lump-sum or the yearly payments, winning the jackpot is life-changing.

As the jackpot continues to grow, more people are watching the results closely.

TOPICS: Powerball

-

- How to get free Powerball tickets as the jackpot hits $930 million — Simple steps to try your luck

- Two Kentucky players hit winning Powerball tickets in Monday night’s big drawing

- Powerball prize surges to a massive $930 million after no jackpot winner on Monday night

- Powerball and Pick 2 Day results for Dec. 8 released: Did your Pennsylvania Lottery ticket win?